Overview of Real Estate Investment’s Role in the UK Financial Market

Real estate investment UK holds a central position in the UK financial market overview, acting as a cornerstone of the broader economy. The sheer size of this sector reflects its importance; property assets constitute a significant proportion of national wealth and financial holdings. This scale highlights the economic impact of real estate, which extends far beyond simple asset value.

The UK’s real estate market functions through various key channels, each influencing different financial sectors. For instance, capital tied up in property transactions fuels banking activity via mortgage lending and commercial loans, underscoring the interdependence between real estate and banking. Additionally, regulatory frameworks shape investment patterns, affecting liquidity and market stability. The interplay between real estate investment UK and financial services demonstrates the market’s multifaceted influence on economic health.

In parallel : What Are the Latest Trends Shaping the UK Real Estate Finance Market?

Investment flows into property markets also affect local and regional economies, shaping employment, retail demand, and urban development. This reinforces real estate’s role as more than just an asset class; it is a driver of structural economic rhythms within the UK financial market overview. Ultimately, understanding real estate investment UK offers critical insight into the country’s economic framework and financial system dynamics.

Impact of Real Estate Investment on Property Prices and Market Liquidity

Real estate investment UK plays a pivotal role in shaping UK property prices through the continuous inflow of capital. As investment increases, particularly in sought-after regions, property values trend upward due to heightened demand. This dynamic is notably pronounced in metropolitan areas where demand outpaces supply, driving regional pricing disparities. Conversely, in areas with limited investment, prices may stagnate or decline, highlighting how capital distribution directly influences property market geography.

Also to see : What are innovative financing options for UK real estate developments?

The relationship between real estate investment activity and market liquidity is fundamental to the broader UK financial market overview. High levels of investment typically enhance liquidity by increasing transaction volumes and reducing the time properties remain on the market. This fluidity benefits both buyers and sellers, providing a more efficient market environment. However, excessive speculation or rapid capital inflows without corresponding supply can distort pricing, potentially leading to overheated markets.

Price movements resulting from these investment trends have significant implications for both residential and commercial sectors. Rising UK property prices can improve asset values and investor confidence but may also impact affordability for first-time buyers and businesses seeking premises. In the commercial sector, shifts in demand influenced by real estate investment UK affect rental yields and vacancy rates, further influencing market stability. Understanding these mechanisms provides insight into how real estate investment drives economic impact through the intricate balance of supply, demand, and liquidity within the property market.

Influence on Financial Stability and Banking Sector

The banking sector in the UK maintains substantial exposure to real estate through mortgage lending and commercial property financing. This close link means that fluctuations in the property market can directly translate into financial stability UK concerns. When property values decline sharply, banks may face increased real estate credit risk, as borrowers struggle to meet repayments against depreciated collateral. This risk can amplify systemic vulnerabilities, impacting not only financial institutions but also the broader economy.

Property market downturns often propagate through banking channels, highlighting the intertwined nature of the banking exposure property sector and market health. Banks employ risk management strategies to mitigate these exposures, including stress testing portfolios against real estate shocks. Nonetheless, rapid shifts in UK property prices, influenced by investment cycles and economic variables, continue to pose challenges for maintaining resilience in financial institutions.

Regulatory frameworks aim to curb excessive risk-taking linked to real estate. Measures such as capital requirements and lending limits are designed to safeguard financial stability UK by controlling banks’ property sector exposures. These regulations promote prudent lending practices, reducing the likelihood of credit crises triggered by real estate market volatility. Consequently, understanding the dynamics of real estate investment UK is crucial for assessing the stability and risk profile of the UK financial system.

Real Estate Investment Trends and Economic Performance

Recent real estate investment UK trends show a growing participation of both domestic and foreign investors, reflecting confidence in the market’s resilience. Domestic investors often focus on residential and commercial developments, while foreign capital typically targets prime London locations and other major cities. This inflow contributes significantly to the UK financial market overview by injecting liquidity and fostering development projects that support continued economic activity.

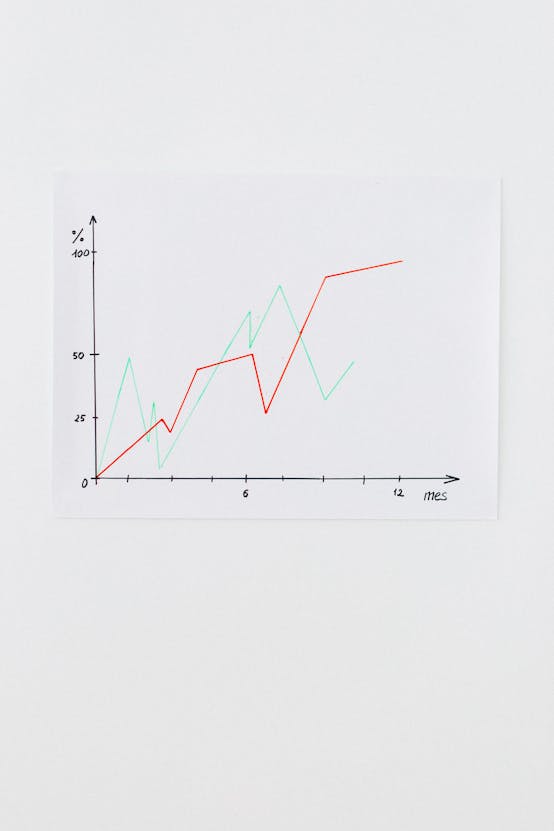

Real estate investment directly influences the broader economy as a key contributor to economic growth drivers. The sector supports employment across construction, property management, and ancillary services, creating a ripple effect that boosts wealth creation and consumer spending. This is evident in the role real estate plays in generating both short-term jobs and long-term assets, aligning with GDP growth patterns. For example, increased investment activity correlates with elevated construction output, which feeds into national economic statistics.

The cyclical nature of real estate markets is closely tied to fluctuations in economic performance. Periods of rising investment and project development tend to coincide with expanding economic conditions, enhancing the financial market’s robustness. Conversely, downturns in property markets may lead to slowdowns in employment and investment, demonstrating the sector’s integral role in shaping the UK’s economic landscape. Understanding these cycles provides essential context for assessing both opportunities and risks within the UK financial market overview.

Indirect Effects: Capital Flows, Investor Sentiment, and Related Sectors

Capital flow UK linked to real estate investment serves as a vital conduit for financial resources entering and circulating within the UK financial market overview. Large-scale international capital inflows, particularly from institutional investors and sovereign wealth funds, play a pivotal role in financing property developments and acquisitions. These capital flows enhance liquidity and contribute to price stability, while sudden shifts can trigger volatility in both residential and commercial property segments.

Investor sentiment closely intertwined with real estate investment UK exerts strong influence not only within the property market but also across diverse asset classes. Positive sentiment encourages further capital deployment into property, boosting market confidence and attracting broader investment across equities, bonds, and alternative assets. Conversely, waning sentiment in real estate can lead to cautious behavior among investors, causing a retrenchment visible in diminished cross-sector capital allocation. This interconnection underscores how shifts in property market perception ripple through the UK financial market overview.

The economic impact of real estate investment UK extends to related industries, creating significant spillover effects. Construction benefits directly from increased property development activity, leading to job creation and procurement of materials and services. Retail sectors often experience changes in demand linked to residential and commercial occupancy rates, while property management and professional services expand in response to growing portfolio needs. These interdependencies illustrate how capital flow UK originating in real estate stimulates a network of sectors that contribute to overall economic vitality and complexity.