Current Macroeconomic Influences on UK Real Estate Finance

Macroeconomic factors play a pivotal role in shaping UK real estate finance trends, with interest rate movements by the Bank of England at the forefront. The recent series of interest rate hikes has directly impacted lending costs, causing borrowing expenses for developers and investors to increase. This shift influences both the demand for loans and the willingness of lenders to finance property projects. Higher rates often tighten credit availability, compelling borrowers to reassess financing structures and investment viability.

Inflation remains a critical driver affecting property finance decisions. Rising inflation erodes real returns on investments and pushes caution among lenders and investors who need to factor in potential cost pressures and yield adjustments. The economic forecast signals uncertainty with inflationary pressures expected to persist in the near term, making lenders more vigilant in evaluating the risk profiles of property loans.

Have you seen this : How Does Real Estate Investment Influence the UK Financial Market?

Key economic indicators such as GDP growth, unemployment rates, and consumer confidence indices also shape market sentiment. Slower economic growth diminishes overall demand for commercial and residential properties, while rising unemployment can reduce rental income security, further influencing lender risk appetite and investor confidence. These macroeconomic signals collectively cause a cautious approach in the UK real estate finance sector, with stakeholders prioritizing conservative lending and investment strategies to navigate the evolving landscape.

Evolving Lending Practices and Funding Models

Lending trends in UK real estate finance have undergone significant transformation, notably due to shifts in lender appetites and risk profiles. Traditional banks have become more cautious, tightening underwriting standards as a response to the recent interest rate impact and ongoing economic forecast uncertainties. This has raised the bar for borrower requirements, with increased demand for stronger credit histories, higher equity contributions, and robust project viability assessments.

Also read : What are innovative financing options for UK real estate developments?

Consequently, alternative lenders UK have risen to prominence, filling the gap left by conventional financing sources. Private credit funds, specialist debt providers, and online lending platforms offer more flexible financing models that cater to developers and investors seeking speed and adaptability. These alternative financing platforms often provide tailored lending structures, including mezzanine finance and bridge loans, which accommodate complex projects or borrowing needs that traditional lenders may deem too risky.

Loan structures have evolved accordingly, with greater emphasis on short-term financing and adjustable terms aligned with market conditions influenced by the economic forecast. Borrowers are increasingly required to incorporate contingency plans and stress-testing scenarios to meet lender scrutiny. This shift encourages more sophisticated financial planning and risk management, reflecting the broader real estate finance trends where adaptability and resilience have become paramount.

Regulatory Changes Affecting Real Estate Finance

Recent real estate finance regulations UK updates have introduced significant changes that directly affect financing practices and risk management strategies. Key regulatory revisions enacted between 2023 and 2024 emphasize stricter compliance standards for property-related lending, reflecting heightened scrutiny by financial authorities such as the FCA and PRA. These changes aim to ensure that lenders maintain prudent underwriting and enhance transparency regarding loan risks.

The FCA’s updated guidance mandates more comprehensive affordability assessments and due diligence, requiring lenders to incorporate forward-looking economic scenarios into their risk models. This approach aligns with the broader economic forecast, encouraging lenders to prepare for market volatility and potential downturns. Additionally, new compliance updates also emphasize anti-money laundering protocols and disclosure requirements, impacting both developers and investors who seek financing within the UK real estate sector.

For lenders, adherence to these regulatory requirements means adjusting loan structures and increasing documentation rigor. Developers and investors must also respond by demonstrating stronger financial resilience and operational transparency to meet evolving regulatory expectations. Overall, these regulatory changes promote more sustainable lending practices, safeguarding market stability while reinforcing responsible investment behavior in the face of ongoing interest rate impact and macroeconomic uncertainties.

Current Macroeconomic Influences on UK Real Estate Finance

Understanding the interest rate impact is essential when analysing UK real estate finance trends. The Bank of England’s recent increases in interest rates have led to higher borrowing costs, directly influencing the availability and affordability of loans for property developers and investors. This rise in financing expenses often restrains demand for new debt and compels borrowers to seek more conservative or innovative funding structures.

In addition to interest rates, the broader economic forecast affects lending decisions significantly. Persistent inflationary pressures reduce the real value of returns, prompting both lenders and investors to adopt a more cautious stance. Inflation influences operating costs, rental yields, and valuations, all of which are critical factors when assessing the viability of property investments within the current macroeconomic framework.

Key economic indicators also shape market sentiment. For example, slowed GDP growth signals reduced economic activity, which can dampen demand for commercial and residential real estate. Elevated unemployment rates increase income uncertainty, weakening tenant demand and rental income stability. Moreover, consumer confidence indexes provide insight into spending and investment behaviours, affecting both loan demand and property market dynamics.

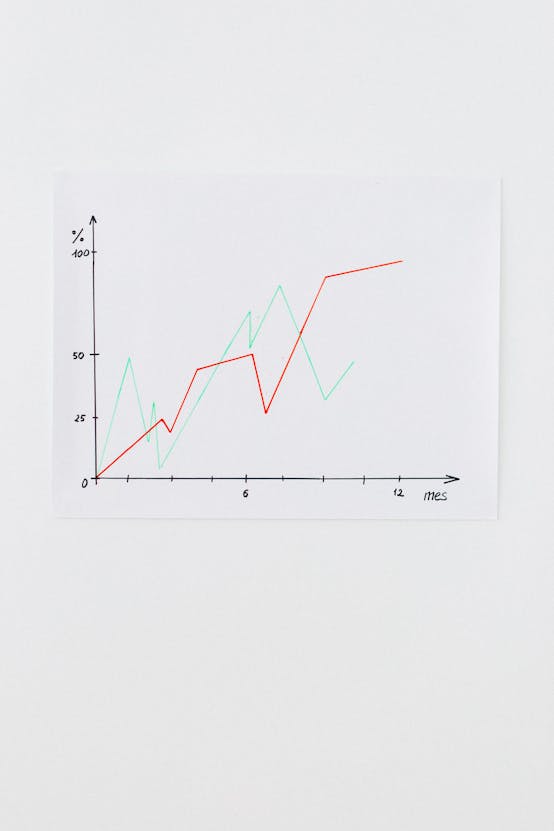

Summarising these influences, the UK real estate finance trends of today reflect a market that is adapting to increased costs of capital, cautious growth expectations, and evolving lender risk appetites. Stakeholders must incorporate these macroeconomic realities into their financial models and investment strategies to navigate the complex environment effectively.

Environmental, Social, and Governance (ESG) Factors in Property Finance

ESG real estate finance UK is increasingly shaping lending decisions, reflecting a broader shift towards sustainable investing within the property sector. Lenders now incorporate ESG criteria to assess not only financial viability but also environmental and social impacts, influencing the approval and structuring of loans. This emphasis on sustainability encourages developers and investors to prioritise projects that demonstrate strong environmental stewardship and social responsibility.

Green lending has emerged as a significant component of this trend, with specialised financing products designed to support energy-efficient buildings and sustainable developments. These green finance products often come with incentives such as preferential interest rates or extended terms to promote environmentally friendly construction and renovations. As a result, sustainable investing is not just ethically motivated—it carries tangible financial benefits within the UK real estate finance ecosystem.

The impact of ESG factors extends to property valuations and investor appeal. Properties that meet ESG standards typically command higher valuations due to lower operating costs, reduced regulatory risks, and increased tenant demand for sustainable spaces. This creates a positive feedback loop where adherence to ESG principles enhances marketability and long-term investment performance, reinforcing the growing importance of ESG real estate finance UK to stakeholders aiming for future-proof portfolios.

Current Macroeconomic Influences on UK Real Estate Finance

The interest rate impact from the Bank of England remains a primary force shaping UK real estate finance trends. Recent rate hikes have led to increased borrowing costs, which in turn reduce loan demand from developers and investors. This tightening effect compels market participants to carefully reevaluate project feasibility under higher financing expenses, often resulting in more conservative capital deployment.

Inflation, intertwined with the broader economic forecast, further complicates property finance decisions. Persistent inflation diminishes investment returns by increasing operational costs and lowering real yields. Consequently, lenders adopt stricter risk assessments to safeguard against cost overruns and valuation declines that may arise under sustained inflationary conditions. Accurate inflation projections become essential inputs in loan underwriting and portfolio management, reflecting the cautious stance across UK real estate finance trends.

Key economic indicators offer sharper insights into market sentiment. Slower GDP growth signals subdued demand for both residential and commercial properties, impacting overall transaction volumes. Elevated unemployment rates introduce uncertainties around rental income stability, prompting lenders to scrutinize borrower resilience more rigorously. Additionally, consumer confidence indexes provide valuable signals on spending power and investment appetite, influencing pricing and availability of credit throughout the sector.

Together, these macroeconomic elements converge to create an environment where UK real estate finance participants must integrate the interest rate impact, inflation outlook, and relevant economic indicators to craft robust investment and lending strategies. This integrated approach helps stakeholders mitigate risks stemming from a volatile economic forecast and maintain alignment with evolving market dynamics.